Debt Securities

- More

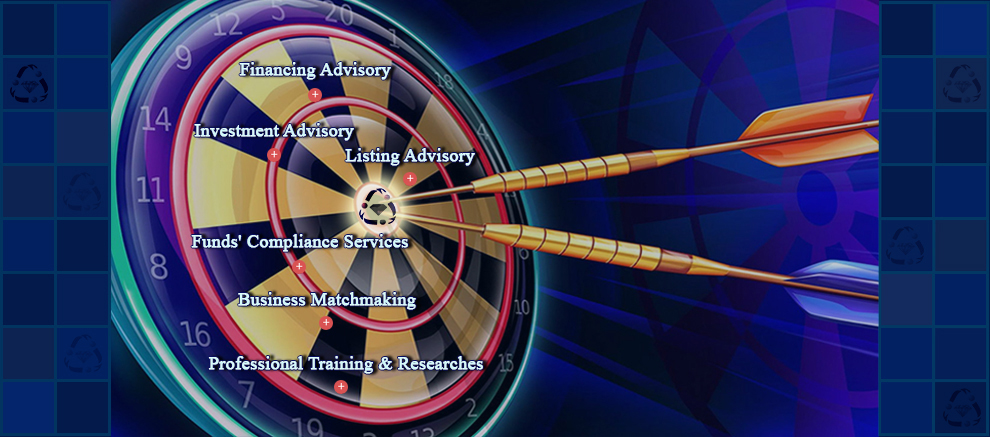

Financing Advisory

Nikigostar Investment Advisor provides firms with advisory services on different financing methods and manages the whole financing process. It helps firms to select the most appropriate financing method, models modern financing methods based on their assets and liabilities, and manages financing operation using expertise and knowledge and the conditions and requirements of firms.

Nikigostar may provide companies and firms with extensive financing services through the following instruments in capital market:- • Debt Securities

- • Equity Securities

- • Establishment and Operation of Project Funds

- • Establishment and Operation of Real Estate Funds

- • International Financing

- More

Investment Advisory

Nikigostar Investment Advisor uses various asset management techniques to provide a set of professional services to its customers:

- • Fund Management

- • Portfolio Management

- • Valuation Services

- • Due Diligence

- • Transactions

- • Business Development

- More

Listing Advisory

Nikigostar may provide the applicants with extensive services on listing in mentioned markets. The services are as follows:

- • Preparation of companies for listing in Tehran stock exchange or Iran Farabourse

- • Listing in Tehran stock exchange or Iran Farabourse

- • Corporate governance services

- • Listing companies in international financial markets

Nikigostar has the experience and background of preparing companies for listing in international capital markets. To do this, it provides extensive services on examining and selecting target market, measuring company status, determining regulatory gaps between company statuses and listing requirements in each stock exchange, designing an action plan to achieve listing criteria, and negotiating with international advisors and other required measures.

Close - More

Funds' Compliance Services

The compliant body of a fund who is investor rights' preserver, is responsible for continuous supervision of fund's executive bodies' performance and controlling fund incomes and payments and cash inflows and outflows. Compliant bodies' activities vary as far as fund type, articles of association, and prospectus. Nikigostar is ready to play the role of compliant body in the following funds:

- • Exchange-traded Funds (ETFs)

- • Equity funds

- • Fixed-income funds

- • Real estate funds

- • Charity funds

- • Market maker funds

- • Project funds

- More

Business Matchmaking

Nikigostar tries to identify, select, and introduce proper business partners through its extensive communications at national and international levels, identification of needs and market of products and services of companies and project owners. Nikigostar identifies foreign investors in different industries who intend to make short- and/or long-term investments in Iran and introduces them to investable projects after negotiating and holding meetings with owners and financiers. Considering Nikigostar's distinguished status in Iran's Capital Market, this company is a reference for different companies and provides any required services for them.

Close - More

Professional Training and Researches

Nikigostar Investment Advisor designs its training courses using knowledge of the most prominent professors in proportion to the modern needs and on the fields required by investors and companies. The courses are designed and held according to the knowledge of participants with varied objectives in a complete technical, interactive and operational manner in two types of Public Courses and Dedicated to a Customer Courses (In-House).

Nikigostar has already held the following training courses and it is prepared to hold them now:- • Introduction to financing instruments in capital market

- • Techno-fundamental and technical analysis- Advanced level

- • Financial management for non-financial managers

- • Analysis of legal clients with a credit approach

- • Risk management

- • Liquidity management

As one of the financial institutions registered with Iran's Securities and Exchange Organization, Nikigostar has become capable of providing advisory services on financing the firms' financial needs through issuing participation bonds and various types of Islamic bonds/ Sukuk (Lease/ Ijarah, Murabaha, etc.) using the specialized workforce and the required knowledge and experience in this field. It organizes issuance of securities and manages securities issuance process. In other words, it performs all measures ranging from identification of the executive bodies for issuance of securities to negotiation and preliminary agreement with them, consultation in a contracting process, etc. That is, a securities issuance project is carried out as "money in customers' accounts". Following services can be provided in this field:

• Acting as the legal representation to follow up legal procedures to obtain financing permissions from competent authorities

• Reviewing the financing project of a firm, advising on a proper financing method, and preparing a feasibility study report

• Preparing required reports based on the items announced by Securities and Exchange Organization to obtain securities issuance permission

• Reviewing information and the documentation used to prepare a feasibility study report and obtaining the comments of experts, auditors, and competent legal entities on the reports, if required

• Necessary coordinating with Capital Market Central Asset Management Company to determine an intermediate institution (publisher) to issue the securities on securities issuance management

• Studying the conditions of a firm and offering suggestions to prepare it eligible to issue securities, method of sales or underwriting, scheduling to publish and offer securities, and providing guidance to select a proper agent to offer securities

• Identifying executive bodies, participating in negotiations, and providing advisory services on selecting and concluding required contracts with any executive body of securities issuance process

• Following up obtaining permissions from the relevant authorities and issuance of securities to ensure the transfer of money to the account of the firm